ALLIANCE RESOURCE PARTNERS (ARLP)·Q4 2025 Earnings Summary

Alliance Resource Partners Delivers 406% Net Income Surge as Coal Operations Rebound

February 2, 2026 · by Fintool AI Agent

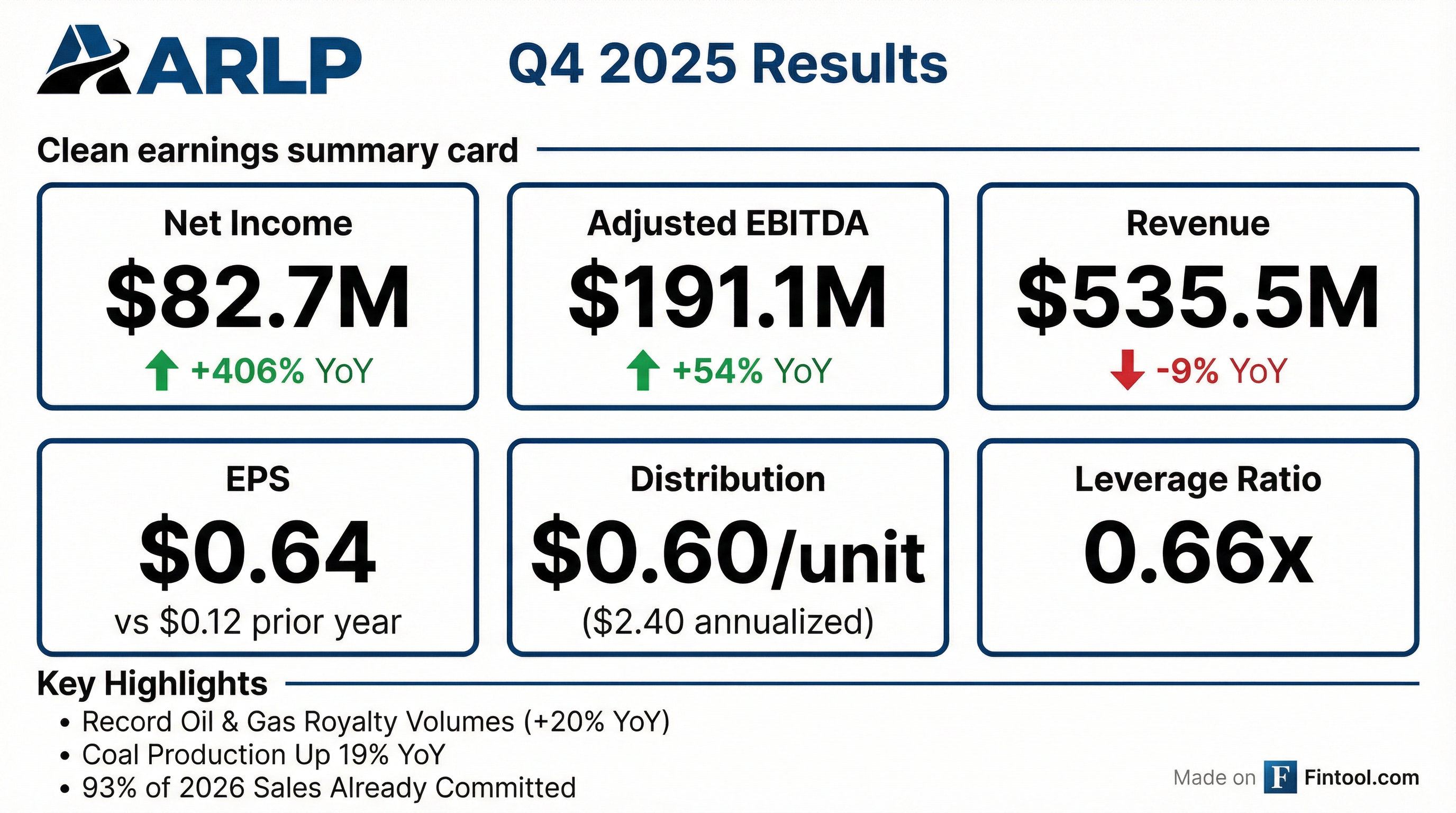

Alliance Resource Partners, L.P. (NASDAQ: ARLP), the second-largest coal producer in the eastern United States, reported Q4 2025 results that showcased a dramatic earnings recovery driven by operational improvements, reduced costs, and investment gains. Net income surged 406% year-over-year to $82.7 million while Adjusted EBITDA jumped 54% to $191.1 million, despite a 9.2% revenue decline.

The partnership declared a quarterly cash distribution of $0.60 per unit and provided 2026 guidance projecting higher production volumes with continued strong demand from utilities amid tightening domestic coal supply.

Did Alliance Resource Partners Beat Expectations?

ARLP's Q4 2025 results showed dramatic improvement in profitability metrics despite lower revenue:

The dramatic net income improvement was driven by:

- Reduced operating expenses: Down 19.9% YoY

- No asset impairments: Q4 2024 included $31.1M impairment charge

- Investment income: $17.5M gain from coal-fired power plant investment

- Cost efficiency: Segment Adjusted EBITDA Expense per ton fell 16.3%

Revenue declined primarily due to lower coal sales prices and reduced transportation revenues, partially offset by record oil & gas royalty volumes.

What Drove the Operational Improvement?

Coal Operations

Coal production volumes increased 18.7% year-over-year in Q4 2025, though sales volumes declined 3.6% due to transportation delays and timing of committed sales.

Key operational highlights:

- Hamilton mine achieved record full year clean tons and yield

- Segment EBITDA Expense per ton improved 14.4% in Illinois Basin and 17.5% in Appalachia

- Coal inventory increased to 1.1 million tons

- Tunnel Ridge represented 73% of Appalachia sales tons but generated 98% of region's cash flow in 2025

Oil & Gas Royalties

The royalties segment delivered record volumes with oil & gas royalties up 20.2% year-over-year:

What Did Management Guide for 2026?

CEO Joseph Craft provided optimistic 2026 guidance, citing strong contracting momentum and favorable market fundamentals:

Critical forward-looking metrics:

- 93% committed: 32.2 million tons already committed and priced for 2026

- 2027 visibility: 20.9 million tons committed for 2027

- Mettiki reduction: Guidance reflects impact of WARN Act notices disclosed last week

What Did Management Say About Market Fundamentals?

CEO Joseph Craft highlighted several bullish factors for coal demand:

"The December 2025 PJM capacity auction for 2027-2028 delivery years cleared at the FERC-approved cap across the entire region, with every megawatt of coal capacity selected. At the same time, reserve margins fell below PJM targets, reinforcing the critical need to keep existing, reliable baseload resources online as data center and industrial load growth accelerates."

On the policy environment and coal retirement reversals:

"I want to acknowledge the Trump administration's foresight in supporting policies to preserve coal units and recognize their contribution to grid reliability. From the first day President Trump was sworn into office, one year ago, he understood the importance of preserving all existing base load-generating units in order to protect our national security interest."

Craft noted that utilities in 19 states have reversed or delayed more than 31,000 megawatts of coal retirements based on load growth or reliability concerns, according to America's Power.

On natural gas dynamics:

"February Henry Hub futures climbed to $7.46 per MMBtu on its final trading day compared to $3.68 per MMBtu at the beginning of this year."

How Strong Is the Balance Sheet?

ARLP ended Q4 2025 with a conservatively leveraged balance sheet:

The partnership also generated strong free cash flow of $93.8 million in Q4 2025 and $377.0 million for full year 2025.

Full Year 2025 Summary

How Did the Stock React?

ARLP shares traded at $23.82 on January 30, 2026 (the last trading day before the earnings release). In after-hours trading following the announcement, shares rose to $24.30, up approximately 2%.

The stock is down approximately 22% from its 52-week high of $30.56, reflecting broader concerns about coal demand despite the strong operational results and favorable PJM auction outcomes.

What Changed From Last Quarter?

Comparing Q4 2025 to Q3 2025:

The sequential decline in net income was primarily due to lower revenues and a decrease in the fair value of digital assets, partially offset by reduced operating expenses and increased investment income.

Key Risks and Concerns

Near-term headwinds:

- Mettiki mine workforce reductions per WARN Act notices

- Lower coal sales prices as legacy contracts expire

- Oil price volatility impacting royalty revenues

- Transportation delays affecting Illinois Basin shipments

Structural considerations:

- Continued decline in coal's share of electricity generation

- Environmental regulations and coal plant retirements

- ESG-driven investor and stakeholder pressure

Investment Highlights

Investment in Power Generation: ARLP recognized $17.5 million of investment income related to its share of the increase in fair value of a coal-fired power plant indirectly owned through an equity method investee.

Digital Assets: The partnership held 592 bitcoins valued at $51.8 million as of December 31, 2025, representing a unique diversification strategy among coal producers.

What Happened During the January 2026 Arctic Blast?

CEO Joe Craft provided important context on the January 2026 weather event that underscored coal's reliability value:

"By mid-January, nationwide arctic blast delivered some of the coldest temperatures in years across the Midwest, Mid-Atlantic, and Northeast... These events pushed electricity demand to record winter levels as natural gas deliverability tightened and renewable output remained limited during the hours when generation was needed most."

The impact was dramatic:

Craft emphasized this validates NERC's winter reliability assessment warnings:

"During the most stressed periods over the past couple of weeks, coal-fired generation once again served as the backbone of reliability."

Importantly, initial 2026 guidance did not factor in this Arctic blast, which weather experts expect to continue into mid-February.

Q&A Highlights: What Analysts Asked

Pricing Upside Potential

Analyst Nathan Martin (Benchmark) asked about what could push ARLP to the high end of pricing guidance given 93% committed. CEO Craft explained:

"Some of the tons that we have committed in those basins include optionality for our customers. So, even though the price has increased this quarter because of the Arctic air... there should be some upside that allows for the Illinois Basin pricings to potentially end up at the high end of the range, if not exceeded a little bit."

He added that Appalachia will likely hit the midpoint since Tunnel Ridge is basically sold out with only ~200,000 tons remaining at MC Mining.

Production Capacity

When asked what it would take to increase production if demand continues strengthening:

"Right now, we do not plan to add any units... Our primary growth is gonna just be an improved productivity. We're very focused on improving our productivity specifically in the Illinois Basin."

Craft highlighted investments in Infinitum motor technology for shuttle cars that are improving productivity. River View could add a unit if needed, but no plans to do so without longer-term customer commitments.

2027 Pricing Color

On 2027 contracted pricing:

"Of the tons that we contracted this last quarter... we did contract 1.5 million tons in 2027, and that kind of did price a little bit higher than the high end of our range [for 2026]."

Multi-year contracts (3-5 years) are showing escalating prices year-over-year, with 2028+ pricing higher than 2027.

Inventory Dynamics

Analyst Michael Matheson (Sidoti) noted coal inventory at power plants was significantly down in 2025 with a big burn-off in Q1 2026. When asked if 2025 represents a pricing trough, Craft agreed:

"I think so. Supply is limited. I don't think we're gonna see supply growth. We're actually seeing some mines that will deplete over the next three years... So I do see supply pretty flat, trending down, for the domestic eastern markets, and I believe the demand is gonna go up."

Quarterly Sales Cadence for 2026

CFO Cary Marshall provided detail on expected quarterly volumes:

First quarter EBITDA expense per ton expected 6-10% higher than Q4 2025 due to the extended longwall outage at Hamilton.

Mettiki Mine Closure Details

CFO Marshall provided additional context on the Mettiki situation:

- A key customer's plant outages impacted Q4 2025 shipments

- Customer informed ARLP they cannot commit to additional purchases "for the foreseeable future"

- Mettiki required minimum 1 million tons/year from this customer

- Existing contracts will be fulfilled through March 2026 from inventory

- Full year 2025 segment EBITDA less capex at Mettiki was ~$3.5 million

- Potential impairment to be evaluated in Q1 2026

Gavin Power Plant Investment Income

Analyst Nathan Martin asked about the $17.5 million equity method investment income. CFO Marshall clarified:

"Taking out the part associated with the increase in the fair value of the equity method investment is fair to do. So... a lower run rate on that, more along the lines of $3 million or so per quarter is probably a fair number from a modeling perspective going forward."

CEO Craft added: "We are evaluating other opportunities to invest in existing coal-fired generation. So that is on our radar."

Conference Call Summary

The Q4 2025 earnings conference call was held on February 2, 2026 at 10:00 a.m. Eastern with CEO Joe Craft and CFO Cary Marshall.

View Q4 2025 Earnings Call Transcript

Related Links: